LEGAL

Telephone: (087) 940-8800

Fax: (087) 940-8873

E-mail:

legal@irba.co.zaDISCIPLINARY COMMITTEE

The Disciplinary Committee sat three times during the period to

hear two matters, both of which were part-heard matters that had

commenced previously. These matters were not finalised and will

continue in 2019.

Reportable Irregularities

Reportable Irregularities (RIs) for the quarter July-September 2018

(Note that RIs are reported on quarterly in arrears)

268 second reports were received, of which:

-- RIs were continuing

125

-- RIs were not continuing

140

-- RIs did not exist

3

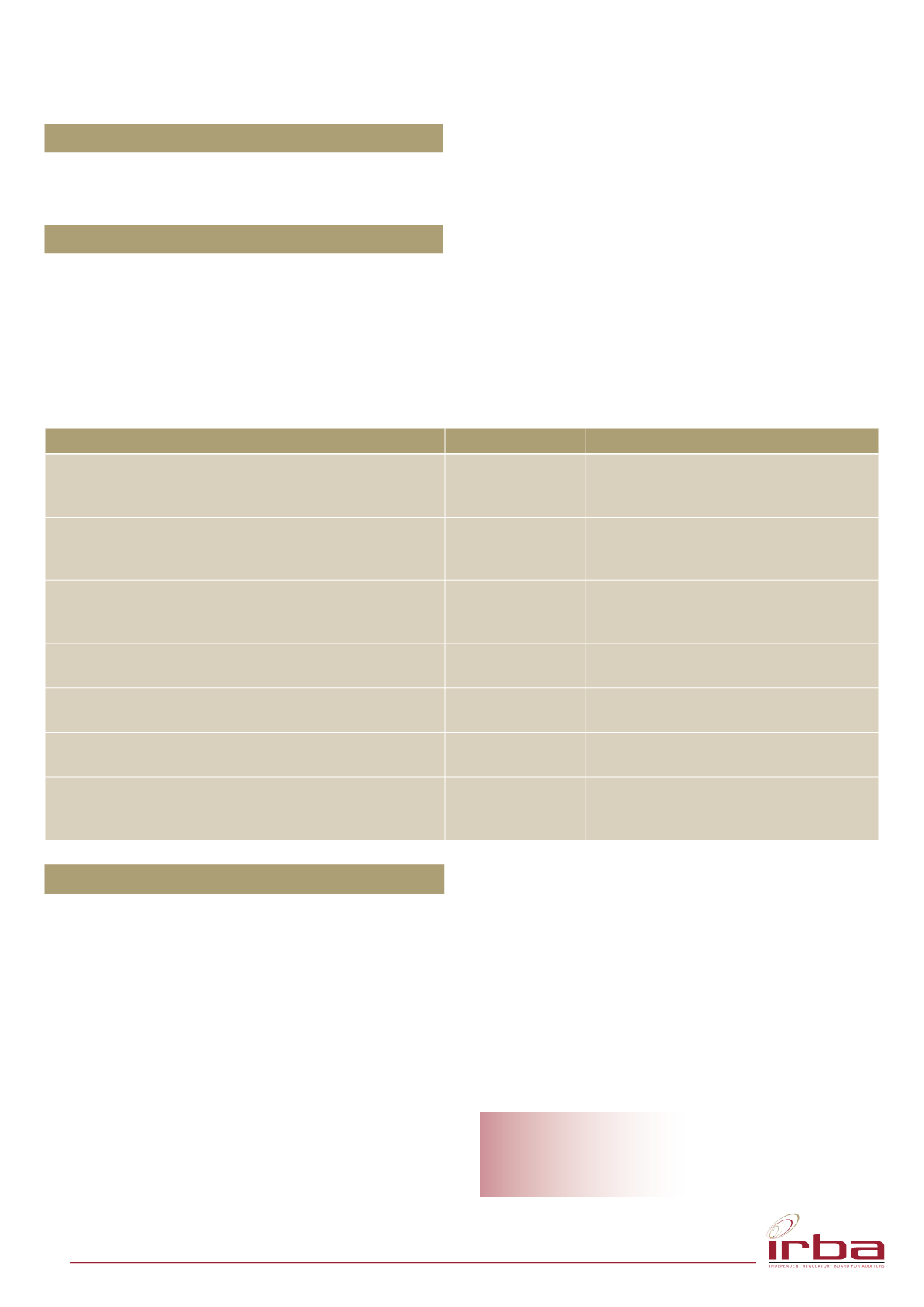

Of the 125 continuing RIs received, the top six types of RIs most

frequently reported, categorised by nature were:

(Note that in many cases, a second report received would identify

more than one RI)

Unlawful Act or Ommission

Reporting Frequency Regulator(s) Informed

-- Tax and VAT-related contraventions, e.g. non-submission of

tax returns, failure to register for tax, non-payment of PAYE,

etc.

25.97%

The South African Revenue Service (SARS).

-- Financial statements not prepared/not approved within the

alloted timeframe.

21.55%

SARS, the Financial Sector Conduct Authority

and the Companies and Intellectual Property

Commission (CIPC).

-- Various Companies Act Contraventions, e.g. reckless

trading, breach of directors’ fiduciary duties, irregular financial

assistance to directors, AGM-related irregularities, etc.

15.47%

The CIPC.

-- Contravention of the Estate Agency Affairs Act, e.g. trading

without a valid fidelity fund certificate, etc.

14.36%

The Estate Agency Affairs Board.

-- Suspected fraud and/or theft, and contravention of the

Prevention and Combatting of Corrupt Activities Act.

3.87%

The Directorate for Priority Crime Investigation,

the Financial Intelligence Centre, etc.

-- Contraventions of the Public Finance Management Act.

1.66%

The Departrment of Public Enterprises, National

Treasury, the Auditor-General, etc.

-- Other, e.g. contraventions of the Johannesburg Stock

Exchange Listing Requirements, the National Credit Act, the

Sectional Title Schemes Management Act, etc.

17.12%

The Johannesburg Stock Exchange, the

National Credit Regulator, the Community

Schemes Ombud Service, etc.

Holding Out

In February 2017, the Special Investigating Unit (SIU) requested that

the IRBA should provide an affidavit as to whether an individual

was registered with the regulator. The request related to an

investigation regarding the granting of membership to contractors

by the Construction Industry Development Board (CIBD). The

application for membership to the CIBD required a submission of

the contractor’s audited annual financial statements.

The individual in question with regards to the query from the SIU was

a registered auditor until his resignation in April 2009. It appeared

that the individual had prepared a set of the contractor’s “audited

annual financial statements” after his resignation from the IRBA, and

this was submitted to the CIBD. An affidavit was duly prepared and

submitted to the SIU confirming this.

In November 2018, Caroline Garbutt, Manager: Registrations, was

served with a subpoena to attend and testify at a disciplinary hearing

instituted by the CIBD against the contractor on 21 November 2018.

At the hearing the contractor admitted guilt thereby curtailing the

proceedings and Ms Garbutt was excused from testifying.

The IRBA did not pursue any action against the registered auditor

since he had passed away in 2010.

Issue 44 | October-December 2018

13