Proficiency Assessment Interviews

The ADP focuses on competency at entry to the profession. The

IRBA also has to ensure that those who wish to enter the profession

after an extended absence from audit are competent. The IRBA

defines extended absence as follows:

• More than three years, and whichever is the latter, since an

applicant:

o

Was registered with the IRBA (assurance);

o

Successfully completed the ADP;

o

Passed the Public Practice Examination;

o

Completed a training contract in public practice; or

o

Worked in an audit and assurance environment.

On application for registration, any applicant who is deemed to have

not been absent for an extended period and intends to start their

own practice is required to supply the IRBA with:

• Comprehensive Continuing Professional Development (CPD)

records;

• An up-to-date CV;

• A short description of why assurance registration is required;

• A practice plan, including a Quality Manual (ISQC) for the

practice they intend to start; and

• The name and RA number of the RA identified as the practice’s

Quality Reviewer. In this regard, also furnish the IRBA with

agreements entered into with the Quality Reviewer.

On application for registration, any applicant who is deemed to have

been absent for an extended period may be required to attend a

proficiency assessment interview where their RA registration will be

considered.

The proficiency assessment interviews are educational in nature.

The applicant is afforded an opportunity to engage with very

experienced staff members of the IRBA and members from the

profession. Therefore, the applicant is guided in how to proceed

with their registration process.

Continuing Professional Development

One of the most important aspects of competence is the

maintenance thereof. Many professionals consider CPD to be a

burden, but it is what should keep us relevant as professionals. With

the ever-changing world of work, professionals must also innovate

and engage in life-long learning.

What is even more important about CPD is that RAs must undertake

CPD activities that are relevant for their specific roles. In this regard

the IRBA’s CPD policy states that:

All RAs (attest and non-attest) will be required to undertake and

maintain a record of CPD activities. Attest RAs must undertake

“audit” relevant CPD. Non-attest RAs are not required to

undertake “audit” relevant CPD but are advised to maintain and

develop their CPD in audit should they wish to change their

registration status from non-attest to attest in the future.

This means that if an RA holds another professional designation, they

must also undertake CPD that is relevant for their other designation.

For example, if you are an RA and you are also registered as a tax

practitioner, you would be required to undertake tax relevant CPD

activities.

The CPD policy also requires RAs to undertake compulsory

ethics CPD. This is to ensure that RAs as professionals base their

workplace activities on an explicit awareness of and commitment

to that which enhances the good in the world of the professional,

centred on but not limited to professional practice itself and its

various stakeholders.

The International Accounting Education Standards

Board (IAESB)

The IAESB is an independent standard-setting body that serves the

public interest by establishing standards in the area of professional

accounting education. It prescribes technical competence and

professional skills, values, ethics and attitudes. Through its activities,

the IAESB enhances education by developing and implementing

International Education Standards (IESs), which increase the

competence of the global accountancy profession. This contributes

to strengthened public trust.

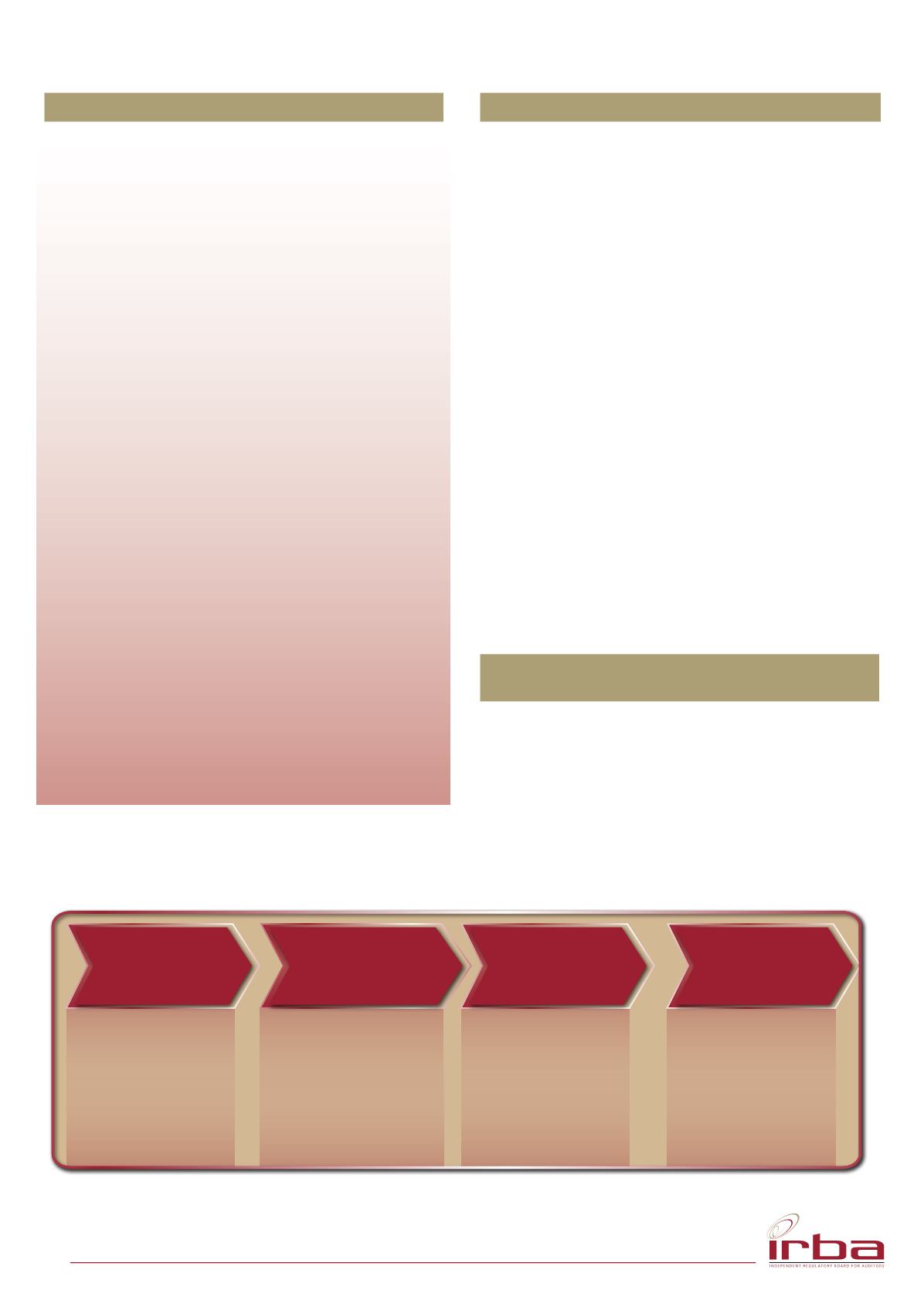

Below is a list of the current IESs:

Entry

Requirements

•IES 1: Entry

requirements to

professional

accounting

education

programme

•IES 2: Technical

competence

•IES 3: Professional skills

•IES 4: Professional values,

ethics and attitudes

•IES 5: Practical experience

•IES 6: Assessment of

professional

competence

•IES 7: Continuing

Professional

Development

•IES 8: Professional

competence for

engagement

partners

responsible for

audit of financial

statements

Initial

Professional

Development

CPD

Special

Standard

EDUCATION AND TRANSFORMATION cont.

Issue 42 | April - June 2018

19