Issue 35 | July-September 2016

14

LEGAL

Disciplinary Committee

The Disciplinary Committee did not sit during this period.

In the last issue I indicated that I would report on the matter of Mr

TM that was finalised in June. What follows is a fair summary of the

charges on which Mr TM was found guilty, the findings and sanction

imposed by the Disciplinary Committee.

The practitioner faced four charges of improper conduct.

The

first charge

(Rules 2.6, 2.13, 2.15 and 2.17 of the Rules

Regarding Improper Conduct) arises from the practitioner’s failure

to comply with the following conditions of a suspended sentence

previously imposed on him pursuant to a disciplinary hearing in

October 2011:

1. Failure to pay the unsuspended portion of the fine on the due

date and failure to pay the cost contribution upon demand; and

2. Failure to attend a course approved by the IRBA for the auditing

of attorneys’ trust accounts, and his subsequent conduct in

proceeding to audit the trust accounts of several attorneys.

The essence of the

second charge

(Rules 2.6, 2.12 and 2.17

of the Rules Regarding Improper Conduct) is that the practitioner

failed to respond to the IRBA’s requests to comply with payment of

the monetary claims arising from the fine imposed on him and the

cost contribution he was directed to pay when he was obliged to

respond to such requests.

The

third charge

(Rules 2.6, 2.12, 2.13 and 2.17 of the Rules

Regarding Improper Conduct) arises from the practitioner’s failure

to complete and submit to the IRBA his annual inspection audit

returns for the period 1 January 2012 to 31 December 2012 in

respect of the assurance work he had performed during that period

relating to the audit of certain attorneys’ trust accounts which he

had undertaken.

In respect of the

fourth charge

(Rules 2.6, 2.12, 2.13 and 2.17 of

the Rules Regarding Improper Conduct), the practitioner had made

an incomplete disclosure in the annual audit inspection returns for

the period 1 January 2013 to 31 December 2013 by knowingly

failing to reflect that during that period he had completed assurance

reports in respect of certain attorneys’ trust accounts whose details

were not disclosed in the returns.

At the commencement of the proceedings on 7 June 2016, the

Committee was notified of a summons which was issued in the

South Gauteng High Court by the practitioner and served on the

IRBA a day before the hearing. Relying on the court proceedings

initiated, the practitioner sought the postponement of the hearing

on the grounds that his conviction and sentence in the previous

proceedings were unlawful and would be set aside by the court.

The request for the postponement was opposed by the

pro forma

complainant. After submissions from the parties, the Committee

resolved to refuse the request for the postponement and directed

that the matter proceed. The practitioner then elected not to

participate in the proceedings, which continued in his absence.

The practitioner was found guilty of all four charges of improper

conduct. In respect of sanction, the Committee ordered the

immediate cancellation of the practitioner’s registration and removal

of his name from the register. The Committee directed that a fair

summary of the charges, the findings and sentence imposed,

without the name of the practitioner or the name of his firm, be

published in the

IRBA News

.

After having been informed of the Committee’s decision, the

practitioner launched two applications (in addition to the summons)

in the South Gauteng High Court to have the findings in the October

2011 and current hearings set aside. The IRBA defended all three

matters and on 6 September 2016 the court set aside all three

matters as being irregular, and they were dismissed with costs.

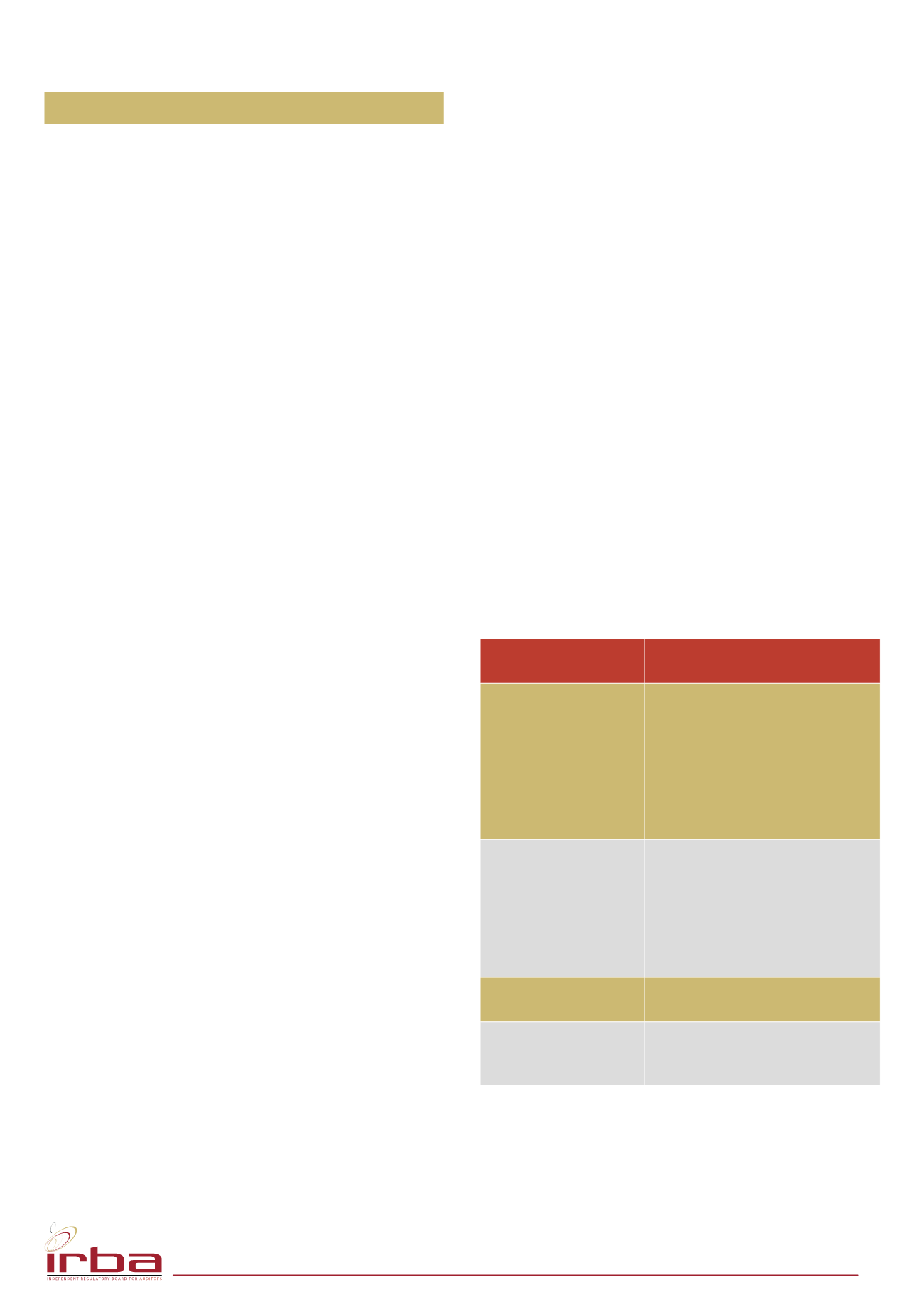

Reportable Irregularities

Reportable irregularities (RIs) for the quarter April-June 2016

(Note that RIs are reported on quarterly in arrears)

201 second reports were received, of which:

-

RIs were continuing

137

-

RIs were not continuing

59

-

RIs did not exist

5

Of the 137 continuing RIs received, the top six types of RIs most

frequently reported, categorised by nature, were:

(Note that in many cases, a second report received would identify more

than one RI)

Unlawful Act or

Ommission

Reporting

Frequency

Regulator(s)

Informed

• Financial statements

not prepared/not

approved within the

alloted timeframe.

45%

South African

Revenue Services

(SARS); Financial

Service Board (FSB);

Companies and

Intellectual Property

Commission (CIPC);

etc.

• Tax-related

contraventions (e.g.

non-submission of

tax returns, failure to

register for tax, non-

payment of PAYE,

etc.).

27%

SARS.

• VAT related

contraventions.

7%

SARS.

• Contraventions of

the Estate Agencies

Affairs Act.

6%

The Estate Agencies

Affairs Board (EAAB).