Issue 35 | July-September 2016

15

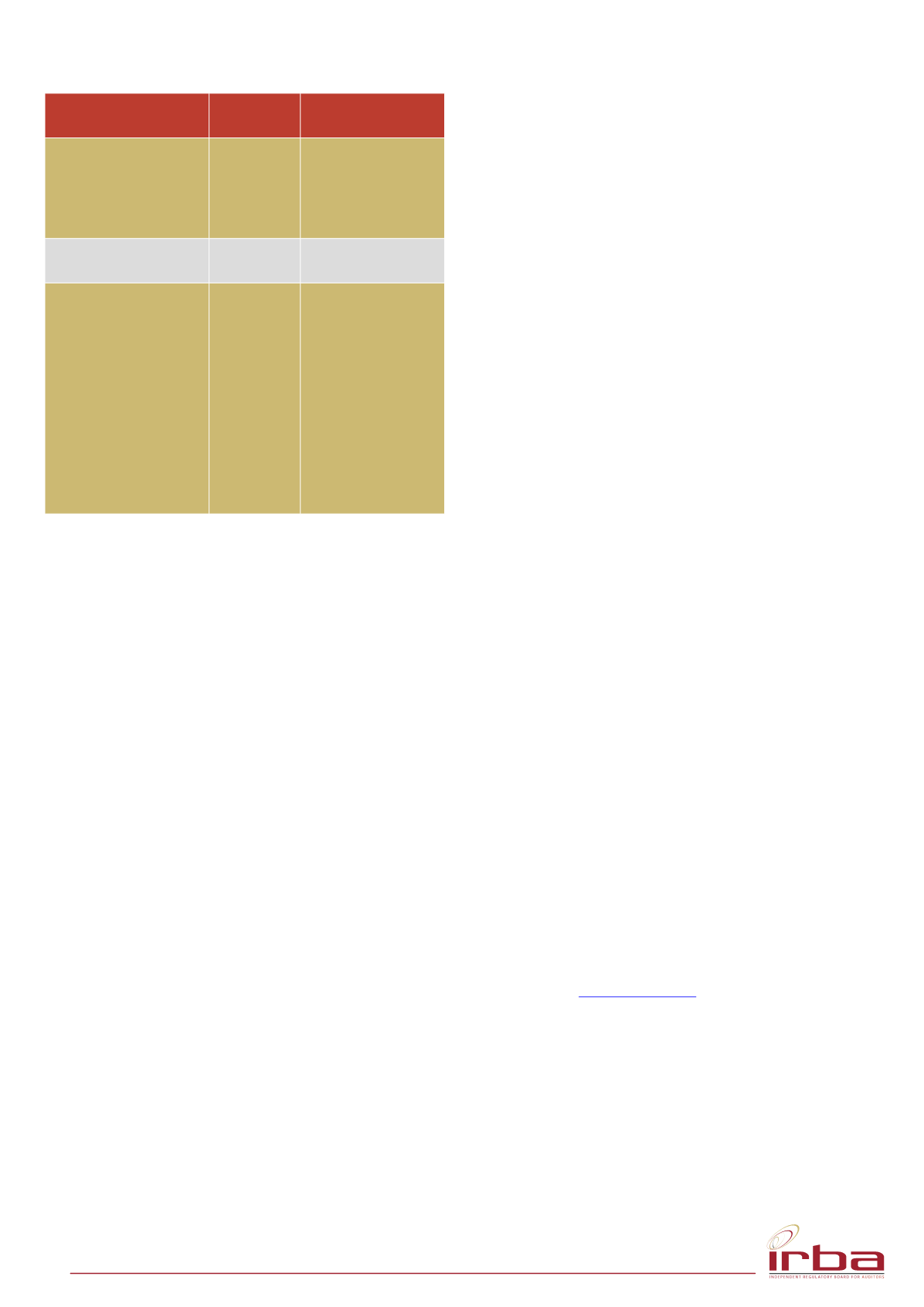

Unlawful Act or

Ommission

Reporting

Frequency

Regulator(s)

Informed

• Contraventions of

FICA, PRECCA, etc.

3%

The Financial

Intelligence Centre

(FIC), Directorate

for Priority Crime

Investigation, etc.

• Trading whilst

technically insolvent.

3%

CIPC.

• Other (e.g.

contraventions of

the Pension Funds

Act; contraventions

of the Attorneys Act;

failure to convene

an AGM; no

reporting processes

for whistleblowers

as required by the

Companies Act;

etc.)

9%

FSB, Relevant Law

Societies, CIPC, etc.

RIs Sent to the CIPC

As part of an ongoing process of continual stakeholder interaction,

the IRBA has been engaged in regular contact sessions with a

number of different regulators. During these sessions a number

of themes considered to be of potential interest to our registered

auditors were discussed at length.

During our discussions held with the CIPC, it was emphasised

that the Commission attaches a high degree of importance to the

RIs, which they receive via our offices from our registered auditors,

regarding instances where the Companies Act has purportedly

been contravened.

In the 2013/2014 financial year it was reported that 160 Compliance

Notices were issued to companies where reasonable grounds

existed that the companies in question had contravened sections

28, 30 and 61(7) of the Companies Act. All of these cases were the

result of RIs that had been reported to the IRBA by our registered

auditors.

Below are some highlights from this compliance drive that was

undertaken:

• At the end of March 2015, Compliance Certificates were

issued to 38 of the companies to which Compliance Notices

were issued.

• In respect of 25 of these companies, authorisation was given to

forward their noncompliances with Compliance Notices to the

National Prosecuting Authority for possible prosecution.

• At that point in time, 15 cases had then also been opened with

the SAPS for purposes of possible prosecution.

• A total of 69 companies were put on a “cold case” list as

the companies in question either did not respond to the

Compliance Notices issued or claimed that they were dormant.

• This “cold case” list will, according to the CIPC, be periodically

reviewed to ascertain if attempts have been made to either

reinstate their CIPC registrations or to have their statuses

changed from dormant to active.

In light of these events, the CIPC also wishes to communicate to

directors and auditors of all CIPC-registered companies the fact

that it has recently secured a criminal conviction in the Specialised

Commercial Crime Court in Bellville against a listed company for its

failure to adhere to a Compliance Notice. In this regard, the CIPC

says a Compliance Notice issued will stay in effect until complied

with – the only exception will be if it has been set aside by the

Companies Tribunal or a court of law.

This secured conviction is of particular significance especially when

viewed in light of a surveillance sweep that the CIPC has recently

conducted on JSE listed companies relating to the accuracy of

declarations of turnover that these companies have been submitting

to the CIPC.

The surveillance sweep, according to the CIPC, has highlighted

certain issues with the manner in which companies have been

completing their CIPC returns. These include examples of

companies having submitted annual returns since 2012, and for

each of their financial years in question during which they actively

traded, they reflected annual turnover figures of zero rand. Where

discrepancies such as these were identified, the CIPC engaged with

the companies concerned to determine the root causes thereof.

In some cases, the discrepancies were found to be either due to

administrative errors or third-party service providers that had been

submitting inaccurate information to the CIPC on behalf of these

companies.

The CIPC requested each of these listed affected companies to first

rectify such inaccuracies and then provide the various stakeholders

with adequate details via the publication of SENS announcements.

This request, according to the CIPC, was made to provide

the affected companies with the opportunity to demonstrate

transparency in their dealings with the Commission. However, as

per a recently published article in the

Financial Mail

, it was stated

that the JSE prohibited these affected companies from using the

SENS to inform the market of details pertaining to the outcomes of

this CIPC surveillance sweep. The CIPC has since taken steps to

publish the names of the contravening companies on its website.

Our registered auditors are advised to contact Ms Lana van Zyl

(Senior Manager: Governance Surveillance Enforcement) from the

CIPC directly at

Lvanzyl@cipc.co.zashould any further information

regarding any of these matters discussed be required.

RIs Relating to the Special Voluntary Disclosure Programme

Regarding the Special Voluntary Disclosure Programme (SVDP),

which was announced by the Minister of Finance during the 2016

Budget Speech, the IRBA would like to emphasise that the due date

for all SVDP application submissions to SARS has recently been

extended from the initial date of 31 March 2017 to a revised date

of 30 June 2017. The IRBA issued a communique to all registered

LEGAL

c o n t .